How to request an extension of time?

You can request more time to electronically file certain information returns. You will automatically receive an

additional one month time extension. It is important to remember that this extension option does not give you additional time to distribute Copy B to the payees.

You can not request additional time for distributing Copy B.

The steps are below:

- Log into the IRS FIRE System. Click on Continue to reach the main menu.

- At the main menu, click on Extension of Time Request.

- Click on Fill-In Extension Form. Click Continue.

- You will see a form that asks for the payer's/filer's information

- Click Submit and a 30-day time extension will automatically be granted. The IRS will diplay a short receipt on the next page. Print and save for your records.

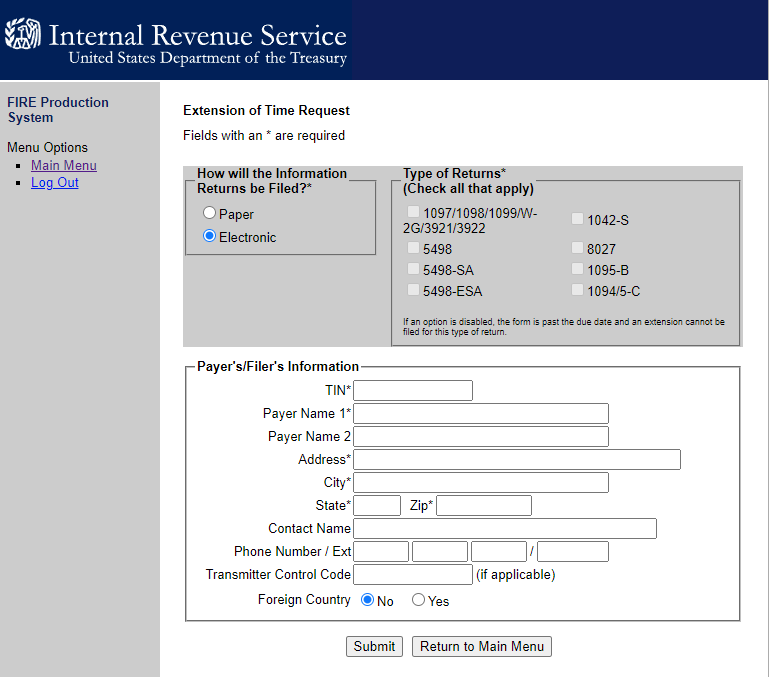

Select how the information returns will be filed, whether by paper or electronically. Select which types of returns you are requesting more time to file. The return types include W-2, 1098/1099/W-2G, 5498, 5498-SA, 5498-ESA, 1042-S and 8027. While the W-2 is filed with SSA, you can select a time extension through the IRS FIRE System.

Type in the payer TIN, name, address, city, state, zip code, contact name, phone number and transmitter control code (if applicable). If you dont have a TCC number, you can leave that box blank. You also select whether this payer address is in a foreign country. If you select no (which is the default), then the payer resides in the United States.

We can efile a 1-month extension on your behalf. We do charge for this service. Just contact sales at (480) 706-6474 and they can file that extension for you.