How to electronically file a 1095-B or 1095-C correction? | AIR

You transmit data to the IRS. You get the results "Accepted With Errors"

and see the following error:

Accepted with Errors

1094C-20-00000001|1|4

1095C-010-01

Form 1095C 'OtherCompletePersonName' and 'SSN' in 'EmployeeInfoGrp' must match IRS database.

/Form109495CTransmittalUpstream/Form1094CUpstreamDetail/Form1095CUpstreamDetail/EmployeeInfoGrp/SSN

This error is telling you that for the Receipt ID 1094C-20-00000001, the 4th employee name/SSN does not

match IRS records. You want to identify and isolate all of the 1095 errors you have and file a correction.

Here are the steps:

- Identify the errors. Read through the error report from the IRS and understand the errors. Name and SSN not matching IRS records is the most common error from the 1095 forms. Our website lists many other errors and why they arose. You can call or email us as well and we can provide insight. Understand all of the errors in the error report.

- Correlate and list the UniqueRecordIDs with the recipient names and SSNs. You will see something that looks like 1094C-20-00000001|1| 4 listed atop of each error. This example shows the Receipt ID of 1094C-20-00000001, the 1094-C ID of 1, and the 1095-C ID of 4. In this example, the 4th employee name/SSN does not match IRS records. Together 1094C-20-00000001|1| 4 is the UniqueRecordID. Go back to your original data and find the 4th recipient and their SSN and write it down next to the UniqueRecordID.

- Prepare a new excel of just the corrections. You don't want to re-submit all of your data; just the records that were in error.

- Add 6 extra columns to the right of the excel file. Name the extra columns First, Middle, Last, Suffix, TIN and CorrectedUniqueRecordID in that order. Type in the original recipient name, SSN and CorrectedUniqueRecordID for each record you are correcting. The IRS uses these 6 extra columns to find the original data that was successfully transmitted. If the original recipient name was incorrect, type in that incorrect recipient name in these 6 extra columns.

- Make whatever changes you want to the data that is to the left of the 6 extra columns. The IRS finds the incorrect record using the 6 extra columns and replaces the contents they have with everything that is to the left of the 6 extra columns.

- Import the excel file into the software.

- File 1095-C Corrections along with a 1094-C without with only Part I on the 1094-C completed. Go to the 1094-C. Look at Box 18 on the 1094-C which is the number of records you are transmitting right now. If you transmitted a file with 250 employees and one (1) record had an error and you want to correct that one record, type 1 in Box 18 on Form 1094-C. That represents the size of this small excel file. Only complete Part I on the 1094-C. Your not efiling a 1094-C correction; just 1095-C corrections. A 1094-C correction would be a separate file/transmission.

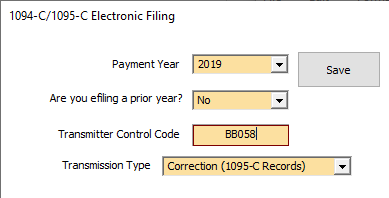

- Change the Transmission Type from Original to 1095-B or 1095-C Correction. Click on File Information Returns Electronically and a box will pop up. In the top left corner you will see this:

- Create the data and manifest file. Upload the XML.

Steps 2, 3 and 4 can be a very tedious task. Our 1095 software has a feature where you can import in your original data file as well as the error report from the IRS and the software will generate a new excel with just the records that were identified as an error and the 6 extra columns all filled out. You then make changes to the data that is to the left of the 6 extra columns.

Change the Transmission Type from Original to Correction (1095-C Records) or Correction (1095-B Records).

If your correction comes back as Accepted, your done. If your correction comes back as Accepted With Errors, then you still have errors in that correction. You can submit another correction or a correction of a correction.

Outsourcing Corrections...

We can prepare and electronically file on your behalf corrections to the IRS. We can prepare

1094-C, 1095-B and/or 1095-C corrections for current or prior years. Please contact

our sales office at (480) 706-6474 and they can get started. Competitive pricing.

Stay compliant, reduce administrative costs and know that the job will get done right.