How to electronically file prior year 1095-B, 1095-C data? | AIR

You can electronically file prior year original or correction data for Forms 1095-B and 1095-C. You can

efile data for any prior year from tax year 2015 to the present tax year.

You can electronically file prior year original or correction data for Forms 1095-B and 1095-C. You can

efile data for any prior year from tax year 2015 to the present tax year.

Here are the steps:

- Use the prior year ACA software to generate the data file. The header and body of the XML data file must match schema for that particular prior year.

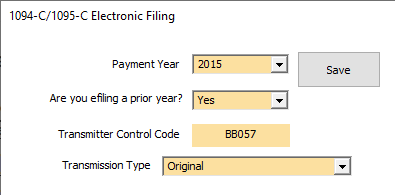

- Use the current year ACA software to generate the manifest file. When your generate the manifest file:

- Select the prior payment year.

- Select Yes that are efiling a prior year.

- Select original or correction as the transmission type

- Double check that PaymentYr reflects the prior payment year.

- Double check that PriorYearDataInd has a 1 and not a 0.

-

Double check that SoftwareId has that prior year software ID which are

listed here:

2018 18A0006885 1095-C

2018 18A0006884 1095-B

2017 17A0005496 1095-C

2017 17A0005495 1095-B

2016 16A0003317 1095-C

2016 16A0003316 1095-B

2015 15A0000123 1095-C

2015 15A0000124 1095-B

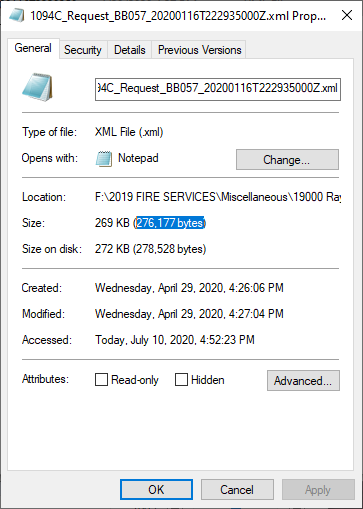

- Calculate and replace the AttachmentByteSizeNum in the manifest matches the value of the data file. Right click on the data file and left click on Properties to find the byte size.

- Calculate and replace the ChecksumAugmentationNum. The IRS uses SHA-256 to calculate the CheckSum. Find a sha-256 calculator (there are lots of free sha-256 calculators online), calculate the sha-256 value using the data file as the input, and copy and paste it into the manifest file. Dont worry if the letters contain in this value are lupper or lower case.

- Make sure that the file name used in the field DocumentSystemFileNm matches the data file name.

Open the manifest file by double clicking on it. You have to double check and make adjustments to the manifest file to make sure its perfect before efiling.

The Byte Size is the value shaded in blue. Make sure the manifest file has that byte size with no commas.

Outsourcing Solutions...

Confused? Don't worry. We can electronically file prior year 1095-B or 1095-C

forms using our TCC number. Let our trained staff import your data from excel, print and mail (if necessary),

and electronically file

on your behalf. We can help eliminate the stress of filing information returns by providing

complete, secure outsourcing solutions. Competitive pricing. Please call our sales office at

(480) 706-6474.

Stay compliant, reduce administrative costs and know that the job will get done right.