IRS Form 1099-LTC (Tax Year 2024)

Long-Term Care and Accelerated Death Benefits

Software

$289.95

-

Use the software today!Transmit directly to the IRS.

- Requires a TCC code issued by the IRS and IDme account.

- Software validate data before you transmit to the IRS.

- Software imports up to 2,500 records. Additional 10,000 record increments can be purchased by calling sales at (480) 706-6474.

Outsourcing

Call for a quote.

- We assign a real person to review your data.

- No TCC required. No IDme. No finger print.

- Let our trained staff import your data from excel, print and mail, and electronically file on your behalf using our TCC number.

- Outsourcing is a flat efilng fee based on each excel file up to and including 1,000 records.

IRS Form 1099-LTC

IRS Form 1099-LTC is used to report payments made under a long-term care (LTC) insurance contract or for accelerated death benefits. The form is typically issued by insurance companies or financial institutions to taxpayers and the IRS when benefits are paid from a long-term care policy or when accelerated death benefits are triggered due to terminal illness or certain chronic conditions.

New Paper/Electronic Filing Threshold...

IRS mandates electronic filing of 10 or more information returns. The new threshold is effective for information returns beginning tax year 2023. FIRE TCC holders who submitted their TCC application prior to September 26, 2021, must complete and submit a new application and verify their identity through ID.me, an IRS provider of sign-in services.

Import from Excel...

Print...

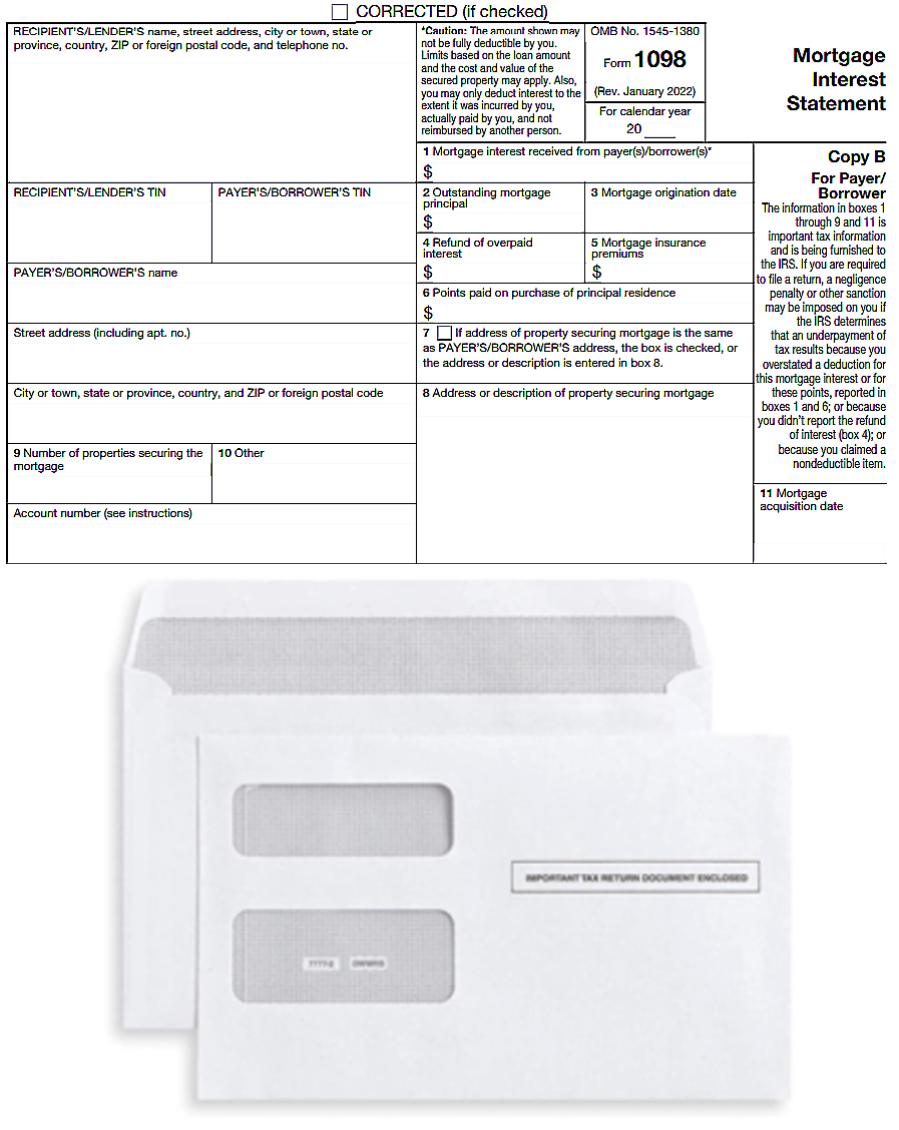

Copy B can be printed with or without instructions and SSN masking. Print on plain paper with black ink, bi- or tri-fold and stuff into any 2-window envelope and the payer and recipient mailing address will line up perfectly. Or print to PDF.

File Directly to the IRS...

1098 software will generate a file formatted according to Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G.

The system is updated each year to reflect format changes that are made by the IRS. 1099FIRE is the only company to offer OneTouch E-Filing. One click of a button will automatically upload data directly to the IRS FIRE system using your login credentials. A receipt of your file will be displayed on screen.

1098 software is valid for the current tax year and prior tax years. Renewals can be purchased at a reduced cost.

Replacements, Corrections, Prior Years......

Need to file an original or correction for a current or prior year? Not a problem. 1098 software let's you print and electronically file originals, replacements, or corrections for current or prior years.

Due Dates...

Furnish Copy B to the borrower by January 31. File electronically by March 31.