ACA Reporting Software

Includes Forms 1095-B, 1095-C and transmittal summaries

Custom

Call for quote

- Customized number of employer EINs and employee SSNs.

- Drag and drop multiple Excel files for automatic PDF conversion.

- The system generates XMLs automatically for each file.

- It also auto-validates all files for seamless processing.

Outsource Solution

$999.95 / As low as

- A true turn-key solution with no software or TCC required.

- Our ACA experts handle importing and converting your data.

- We provide a PDF copy for your review before filing.

- Mailing service starts at $0.80 plus postage, subject to availability.

Individual employer option can import up to 2,500 employees per EIN. Enterprise option up to 5,000 employees. Professional up to 10,000 employees. Call sales at (480) 706-6474 for a large data option.

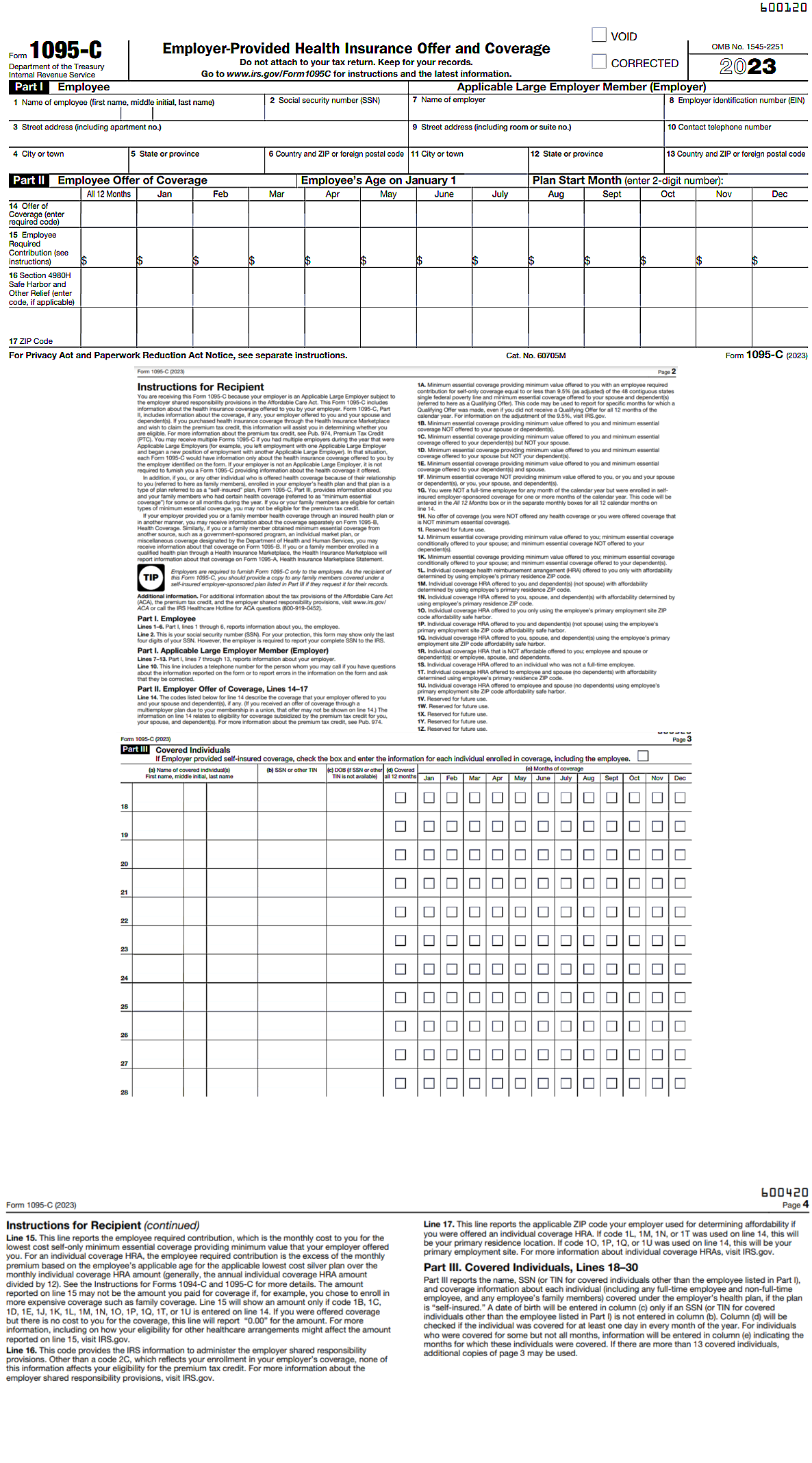

IRS Form 1095-C

Form 1095-C is used by employers to report information about employees' health coverage offered under the Affordable Care Act (ACA). The form is part of the ACA's employer mandate, which requires applicable large employers (ALEs) to offer affordable, minimum essential health coverage to their full-time employees and report the details of that coverage to the Internal Revenue Service (IRS). Form 1094-C serves as a transmittal form that summarizes the employer's overall compliance with the ACA's employer mandate.

New Paper/Electronic Filing Threshold

IRS mandates electronic filing of 10 or more information returns. The new threshold is effective for information returns beginning tax year 2023. An individual filing ACA forms electronically on behalf of the employer must obtain an ID.me account to verify their identity and apply for a Transmitter Control Code.

Import...

Manually key in information on the screen as it would be typed on the form itself. Or import the data from Excel.

Print...

Print the forms on plain paper with blank ink or convert to PDF. Form 1095-C has Part I and Part II printed on one page and Covered Individuals from Part III on a second page. You can print just the forms which consists of 2-pages or print the forms with the addresses and instructions and is 4-pages in length. You can tri-fold and the addresses will align perfectly for a 2-window, #10 size envelope. You stuff, seal and mail. Duplex printing saves time and money when you have a lot of 1095-C forms to mail.

We can print and mail on your behalf. Call our sales office at (480) 706-6474 for an estimate to have us print and mail.

File Directly to the IRS...

Our 1095-C software creates XML files in the format required by the IRS for electronic transmission. Software includes current schema and has a built-in validator to double check for any schema errors before efiling. The system is updated each year to reflect format changes that are made by the IRS.

1095-C software is valid for the tax year 2023 season and prior tax years. Renewals can be purchased at a reduced cost.

Replacements, Corrections, Prior Years...

1095-C software let's you print and electronically file originals, replacements, or corrections for current or prior years.

Due Date/Time Extension...

The 1095-B and 1095-C forms must be postmarked to the recipients by March 2 (March 3 in a leap year), or the next business day if the due date falls on a weekend or holiday.