Updated June 15, 2016. Please reinstall the 1094/1095 software from this link

https://www.1099fire.com/try_now.htm

Reinstalling will give you the most current version that can prepare replacement and/or corrections.

Corrections are used to update an information return that was previously filed and Accepted (with or without errors) by the IRS, but contained erroneous information. Corrections can fix errors reported by IRS or those discovered by Filers

independently. If a file is rejected by the IRS, you put together a replacement file.

Replacements: Transmitters can replace submissions which were rejected. Its easy to do.

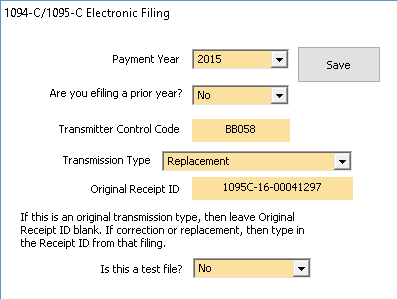

Prepare a new file. Click on File Information Returns Electronically and a box will pop up. In the top left corner you will see this:

Select Replacement from the Transmission Type. Type in the Original Receipt ID that you received when your file was rejected. That’s it. You can now create the data file and manifest file and upload these replacement XML files.

Corrections: Corrections can be made to previous submissions that have been Accepted or Accepted With Errors. If you transmit a file and it comes back as Accepted but later realize you transmitted erroneous data, you need to efile corrections as soon as possible. Accepted With Errors will list your errors. You can clean up your data and transmit a correction.

You only want to correct data which is erroneous. If you submitted 100 records but 1 record had an error, you prepare a correction for this one record in error and transmit that. The IRS states “The Transmitter must furnish corrected statements (physical paper forms) to recipients as soon as possible” which means you have to print and mail a new 1095 form to the employee.

You can not transmit originals and corrections in the same file. Corrections must be separate from original transmissions.

There are different types of corrections and we discuss each below. We go from easy to hard in our discussion of correction types and follow up with examples. If you have questions, ask anytime. Technical support can be reached at support@1099fire.com and (608) 444-6575.

1094-B Corrections: Form 1094-B is the transmittal summary to the 1095-B forms. If you look closely, the 1094-B form does not have a void or corrected check box at the top of the forms. You can’t paper file or efile corrections for IRS Form 1094-B.

1094-C Corrections: Form 1094-C is the transmittal summary to the 1095-C forms. You can efile a correction for the 1094-C forms.

Here are the steps.

1. Do not include 1095-C records.

Put together an excel file with no 1095-C records and update the 1094-C data as much as you like. Import in the 1094-C data.

2. Select 1094-C Transmission Type.

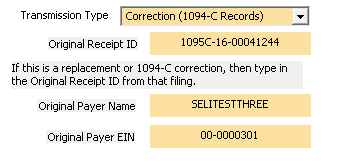

Click on File Information Returns Electronically and you see a screen which looks like this

Select Correction (1094-C Record) as the Transmission Type. Type in the Original Receipt ID that you are trying to correct. Type in the original payer name and original payer EIN. If you transmitted a file and the original payer name or payer EIN was incorrect, type that incorrect information in here. The Receipt ID, Original Payer Name and EIN helps the IRS pinpoint which 1094-C record to correct.

3. Efile. Create the manifest and data file and transmit to the IRS.

1095-B, 1095-C Corrections:

Let’s consider an example as we go through 1095-B, 1095-C corrections.

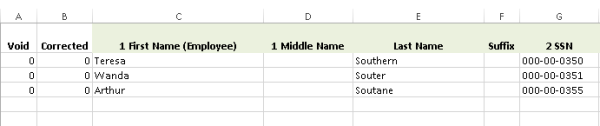

1. Identify the errors. The most current IRS Test Scenario #3 has employees for the business Selitestthree. The correct data is:

Let’s make an intentional mistake and upload Teresa Southern with the SSN 111-00-0350. We transmit and get these results:

Receipt ID: 1095C-16-00041297

Status: Accepted with Errors

AIRTN500 TIN Validation Failed

TIN Validation Failed means the name/TIN combination does not match IRS records (which for this case is true). We can download the error report from the IRS and see

<UniqueRecordId>1095C-16-00041297|1|1</UniqueRecordId>

<ns2:ErrorMessageDetail>

<ns2:ErrorMessageCd>AIRTN500</ns2:ErrorMessageCd>

<ns2:ErrorMessageTxt>TIN Validation Failed</ns2:ErrorMessageTxt>

</ns2:ErrorMessageDetail>

I know, it looks confusing but this

1095C-16-00041297|1|1

means Receipt ID | 1094-C ID | 1095-C ID. In more detail,

Receipt ID is 1095C-16-00041297

1094-C ID is 1 always (In theory, you can submit a data file with the 1094-C followed by its 1095-C records and then another 1094-C and its 1095-C records. But with our software, we only submit one (1) 1094-C per data file and it’s followed by it’s 1095-C records. So the 1094-C ID is always 1 or the 1st 1094-C in the data file.)

1095-C ID of 1 (1st record is the error in this example. If the 15th 1095-C had the error, then you would have typed 15 here.).

Together,

1095C-16-00041297|1|1

is the CorrectedUniqueRecordID. Our first step is to identify the records that are in error and retain these CorrectedUniqueRecordIDs.

2. Prepare a subset of corrections. Prepare a new excel file to import into the software. Make changes to this subset of records. If the SSN was incorrect, change it on this subset. If the Plan Start Month was invalid, correct it now. Make any and all changes you every wanted to make to these records that you are correcting.

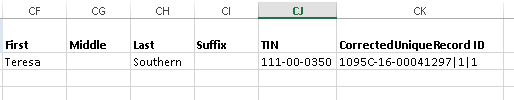

To the far right of the excel file, add 6 extra columns namely First, Middle, Last, Suffix, TIN and CorrectedUniqueRecordID. The far right columns will look something like this:

The IRS webinars say:

Key data fields from the original record to be correct, e.g. Recipient Name

and TIN. Note these fields are necessary to allow the IRS to associate the correction record even when the Unique ID’s don’t match.

If you had an incorrect name or incorrect TIN, type that in these extra columns so that the IRS can match up the incorrect name/TIN that was already submitted with what the IRS has on file.

3. Import the data into the software.

4. File 1095-C Corrections along with a 1094-C without with only Part I on the 1094-C completed.

Go to the 1094-C and Box 18 on the 1094-C. Box 18 represents the number of records you are transmitting right now. If you transmitted 3 employees and one 1 record is erroneous and you want to correct that one record, type 1 in Box 18 on Form 1094-C. That represents the size of this small excel file. Only complete Part I on the 1094-C. Your not efiling a 1094-C correction; just 1095-C corrections. A 1094-C correction would be a separate file/transmission.

5. Click on File Information Returns Electronically and a box will pop up. In the top left corner you will see this:

Change the Transmission Type from Original to 1095-B or 1095-C Correction.

That’s it. You can now create the data file and manifest file and upload these correction XML files.

If your correction comes back as Accepted, your done. If your correction comes back as Accepted With Errors, then you still have errors in that correction. You can submit another correction. Submit as many corrections as you like.