Please reinstall the 1904/1095 software from this link

https://www.1099fire.com/try_now.htm

Reinstalling will give you the most current version that can handle foreign employee mailing addresses.

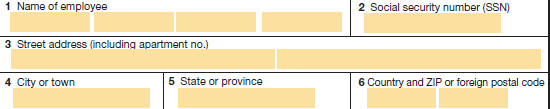

1. Form 1095-C. The employee address section looks like the following:

Type in or import in the best, most complete address you can. In Box 5 State or province, type the 2-character province code only if the employee address is from Canada (CA). If they are from any non-US country other than Canada, leave the province field empty. The list of Canadian province codes are here

Alberta AB

British Columbia BC

Manitoba MB

New Brunswick NB

Newfoundland and Labrador NL

Northwest Territories NT

Nova Scotia NS

Nunavut NU

Ontario ON

Prince Edward Island PE

Quebec QC

Saskatchewan SK

Yukon YT

In Box 6, type the 2 character country code in the 1st box and the zip code in the 2nd box. A list of country codes is here. Blank means US so if they do have a US mailing address, just leave the 1st field in Box 6 blank. US is also acceptable.

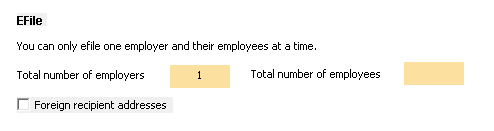

Click on File Information Returns Electronically and you will see this:

By default, the software assumes you have all US mailing addresses when efiling. Its easier and faster to assume US mailing addresses. If you have employees with foreign mailing addresses, then put a check in the check box “Foreign Recipient Addresses” and the software will review each employee country code (which is the 1st field of Box 6). Blank or US means the recipient has a US mailing address. Any country code other than blank or US and the software will use the ForeignAddressGrp XML code.

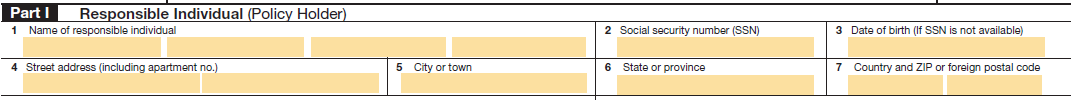

2. Form 1095-B. The employee section of IRS Form 1095-B looks like the following:

Again, type in anything you like in the City. Type in a 2-character province code only if they are from Canada. Type in the 2 character country code.