The 1095 software can handle foreign recipient or employee addresses easily. This article discusses foreign employee addresses.

The 1095 software is not setup to handle foreign employer address. To do this, you have to adjust the data and manifest file manually. Here are the changes you need to make:

1. Use <ForeignMailingAddress>.

The data file has the 1094-C at the top and is followed by the 1095-C records. The employer address on the 1094-C is listed 5-6 lines down from the top. The employer address looks like

<MailingAddressGrp>

<USAddressGrp>

<AddressLine1Txt></AddressLine1Txt>

<irs:CityNm></irs:CityNm>

<USStateCd></USStateCd>

<irs:USZIPCd></irs:USZIPCd>

</USAddressGrp>

</MailingAddressGrp>

and you want to change this to

<MailingAddressGrp>

<ForeignAddressGrp>

<AddressLine1Txt></AddressLine1Txt>

<AddressLine2Txt><AddressLine2Txt>

<irs:CityNm></irs:CityNm>

<CountryCd></CountryCd>

<irs:ForeignProvinceNm></irs:ForeignProvinceNm>

<irs:ForeignPostalCd></irs:ForeignPostalCd>

</ForeignAddressGrp>

</MailingAddressGrp>

You dont have to use AddressLine2Txt or ForeignProvinceNm; both are optional. But you do need everything else.

2. Adjust the manifest file.

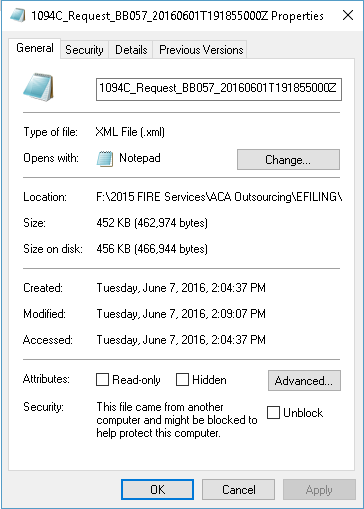

The manifest file describes and defines the data file that is about to be sent. Adjust the data file and go to File/Save. Then right click on the data file and go to Properties and you see this

Write down the file size which in this case is 462974 (its not the size on disk but the file size). Write that number down. Open the manifest file and toward the bottom you see this:

![]()

AttachmentByteSizeNum has to equal the file size of the data file. Adjust AttachmentByteSizeNum to match the new file size and dont use commas (just digits). Go to File/Save to save.