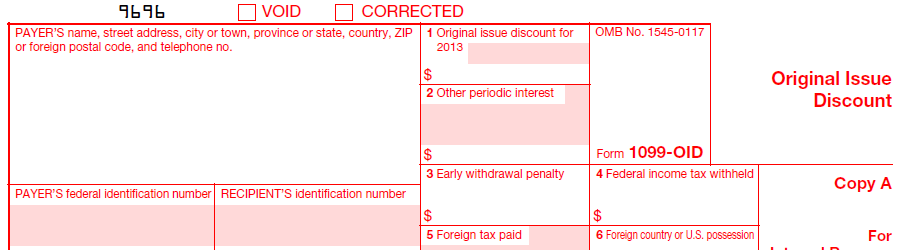

1099-OID Software (Tax Year 2023)

Original Issue Discount

Use the software today! Order online and the shopping cart will e-mail you instructions on how to activate the software.

Outsourcing Solutions

Let our trained staff import your data from excel, print and mail, and electronically

file on your behalf. We can help eliminate the stress of filing information returns

by providing

complete, secure

outsourcing solutions

for IRS Forms 1042-S, 1095, 1097, 1098, 1099, 3921, 3922, 5498, 8027,

8966, 8955-SSA and W-2G. Competitive pricing. Please call our sales office at (480) 706-6474

and they can provide an estimate of the cost. Stay compliant, reduce administrative costs and know

that the job will get done right.

IRS Form 1099-OID - Form 1099-OID is an annual report sent to investors and the Internal Revenue

Service that lists interest income from taxable original-issue

discount securities. The form, which originated during the

1984 tax year, reports the amount of implied and real income

derived from original-issue discount securities such as

Treasury bills, zero-coupon bonds, and commercial paper.

Income shown on a 1099-OID is to be included on Part 1 in

Schedule D of an investor's federal income tax return.

Banks and Financial Institutions

We can only sell the 1099-OID software to Banks or Financial Institutions

with:

1. The name of the Bank and/or financial institution

2. A valid FDIC number and/or ABA routing number of that Bank and/or

Financial Institution.

Furthermore, after ordering, we will call or e-mail an employee from

the Bank that purchased the software to provide

the passcode to register the software.

We can not sell the 1099-OID software to individuals.

Due Dates...

Furnish Copy B to the recipient by January 31.

File Copy A of this form with the IRS by February 28. If you

file electronically,

the due date is March 31.

Related...

1099-OID software, form 1099-OID, Original Issue Discount, irs form 1099-OID