1098-E Software (Tax Year 2023)

Student Loan Interest Statement

Use the software today! Order online and the shopping cart will e-mail you instructions on how to activate the software.

Software

1098-E Electronic Filing Software

$289.95

Software requires a transmitter control code (TCC) issued by the IRS.

Software imports up to 2,500 records. Additional

10,000 record increments can be purchased by calling

sales at (480) 706-6474.

Outsourcing

Let out trained staff import your data from excel, print and

mail, and electronically file on your behalf using our TCC

number. We work quickly and have experienced staff who

can provide complete, secure outsourcing solutions. Starting as

low as $399.

Outsourcing is a flat efilng fee based on each

excel file up to and including 1,000 records. Please

call our office at (480) 706-6474 for an individual quote.

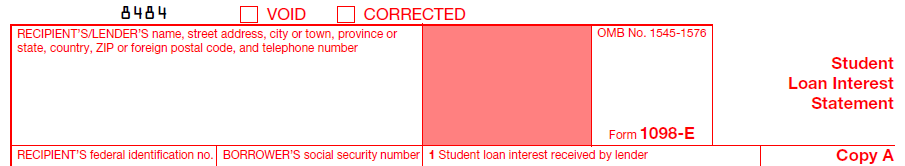

![]() IRS Form 1098-E - Student Loan Interest Statement is the information return on which

financial establishments, government agencies, and educational

institutions that receive student loan payments are required

to report to the Internal Revenue Service. The form

is used for claiming the Student Loan Interest Deduction,

as provided by the Taxpayer Relief Act of 1997.

IRS Form 1098-E - Student Loan Interest Statement is the information return on which

financial establishments, government agencies, and educational

institutions that receive student loan payments are required

to report to the Internal Revenue Service. The form

is used for claiming the Student Loan Interest Deduction,

as provided by the Taxpayer Relief Act of 1997.

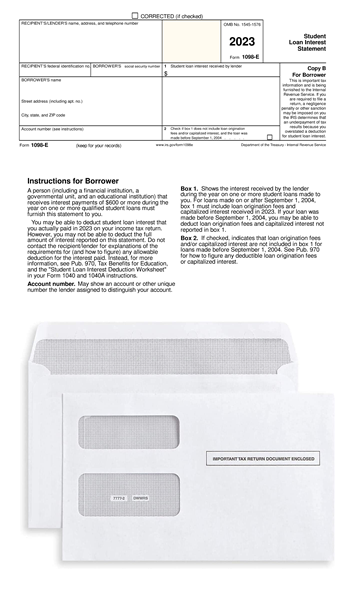

1098-E software makes it easy to import from excel, print Copy B on plain paper with

black ink (or convert to PDF) and electronically file Form 1098-E to the IRS.

New Paper/Electronic Filing Threshold...

IRS mandates electronic filing of 10 or more information returns. The new

threshold is effective for information returns beginning tax year 2023. FIRE TCC holders who submitted their TCC application

prior to September 26, 2021, must complete and submit a new application and verify their identity through ID.me, an IRS

provider of sign-in services.

Import...

Simply import the data from Excel. Sample excel worksheets can be downloaded from this site.

File Directly to the IRS...

1098-E software will generate a file formatted according to Publication 1220, Specifications for Electronic Filing

of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. The system is updated each year to reflect format changes

that are made by the IRS. 1099FIRE is the only company to offer OneTouch E-Filing. One click of a button will

automatically upload data directly to the IRS FIRE system using your login credentials. A receipt of your file will be

displayed on screen.

1098-E software is valid for the tax year 2023 season and prior tax years. Renewals can be purchased at a reduced cost.

Replacements, Corrections, Prior Years...

Need to file an original or correction for a current or prior year? Not a problem. 1098-E

software let's you print and electronically file originals, replacements, or corrections for current or prior years.

Recent Blog Articles...

What is Form 1098-E and Who Should Receive One?

How to complete IRS Form 1098-E

About Form 1098-E

Due Dates...

Furnish Copy B of Form 1098-E to the borrower by January 31. You must paper to

the IRS by February 28 or electronically file by the end of March.

Related...

1098-e software, form 1098-e, Student Loan Interest Statement, IRS Form 1098-E, Student loan interest software,

Tax software for Form 1098-E, IRS-compliant 1098-E software, E-file 1098-E forms, Form 1098-E reporting solutions